Food accounts for 10% of the average American household’s bills and it’s no surprise that this is where many savers go wrong.

Since the pandemic, 37% of shoppers are spending more on each grocery trip than they did before the pandemic hit.

It is safe to say that food can be a money-pit for many but don’t fear – our expert food saving advice is here.

Grocery stores use sneaky tricks to make us spend more. Before we dive into our list, here are a few top tactics to protect your wallet:

- Treats and magazines placed at the checkout. These are impulse buys and a last attempt to grab your cash before you leave.

- Store Layouts make us walk the whole distance. Essential items will be located at the back of the store and we must pass tempting treats on the way.

- Eye-level products are the profitable ones. Look high and low as you browse to avoid falling for the expensive ones at eye level.

Let’s look at 25 top ways to trim our food budget, without tightening our belts.

Table of Contents

- 1. Set a Budget & Stick To it.

- 2. Don’t Shop the Same Store Every Week.

- 3. Use Coupons.

- 4. Look For Alternative Grocery Stores.

- 5. Buy Clearance Items.

- 6. Don’t Waste Food.

- 7. Try Amazon.

- 8. Try Meat-free Days.

- 9. Make the Meat Last.

- 10. Make Money-Conscious Choices.

- 11. Don’t Overeat.

- 12. Buy One Get One Free.

- 13. Use the Cash Envelope System.

- 14. Sign up For Produce Delivery.

- 15. Chop Your Own Veggies.

- 16. Use a Loyalty Card.

- 17. Don’t Make Groceries Your Identity.

- 18. What Organic Products Matter ?

- 19. Try Buying Clubs.

- 20. Make Your Own Bread.

- 21. Try Costco.

- 22. Drink Water.

- 23. Buy Essentials and Limit Treats.

- 24. Stack Your Discounts.

- 25. Skim the Creme-de-la Creme Deals

- Weekly Ads – How We Can Help You Save

1. Set a Budget & Stick To it.

Set a weekly goal. Are you spending $300 on food a week? – try to make that $280. Over a year that 20 dollars goes a long way and an extra $1,000 could be put towards your retirement.

You don’t have to do it the old fashioned way, you can track a budget on your phone and even remind yourself what to spend before plundering the grocery store.

What is the best way to start your budgeting journey? Save the receipts for a few weeks and calculate how much you spend on average. Subtract 10% from that and start from there.

Remember – be flexible and don’t go to extremes by over – rationing the shopping cart as you may be tempted to spend more the following week.

2. Don’t Shop the Same Store Every Week.

The multiple store strategy is key for savings. It’s time consuming but you don’t have to do it every week. Circulating your local area once a month to locate the cheapest groceries across the board will result in savings year round.

3. Use Coupons.

Here at EveryPayJoy we specialize in discounting your grocery list. If you want to know how we can offer coupons to help you save, view the bottom of the article to read our “weekly ads” section.

Five $1 coupons per week will save you $250 per year. We can offer more than 2500 Kraft coupons on any given day – it’s safe to say we have your grocery list covered.

4. Look For Alternative Grocery Stores.

Ethnic and Neighborhood stores usually have excellent offers on meat and cheap homegrown fruits n’ veggies.

When shopping on a budget, don’t be scared to venture into a smaller store and check out what items they sell. Even drugstores offer low prices for canned goods.

5. Buy Clearance Items.

Grocery stores reduce soon-to-expire food. Particularly meat which can be reduced by up to 50%. Deli and dairy items are the same and the best part is that you can freeze them for up to 6 months.

Clearance items are sometimes inconsistent so be wary of fish as many stores don’t refund reduced items.

If you are feeling bold, ask the butcher or fishmonger for any cheaper cuts or for meat that are soon to expire.

6. Don’t Waste Food.

Make a weekly meal of wasted food – Up to 40% of household food is thrown away and the number is rising. Be mindful of waste and serve portions of smaller sizes.

Save all your extra food bits and make a soup at the end of the week. Many extras can be frozen instead of thrown away and the internet is a goldmine for second-hand soup recipes.

7. Try Amazon.

Amazon offers cheap pantry items and if you are a canned-food-fan, online retailers are the way to go. Cereal and shelf products are expensive but Amazon has daily deals on selected pantry products.

8. Try Meat-free Days.

Meat is the most expensive part of a meal so naturally a limited meat shopping list is the way to go. The average American eats 0.6lbs of meat a day. Having one meat-free day per week will shock your savings.

Beware of meat-free alternatives as we all know these break the bank but hopping on the Tofu-Tuesday band wagon will only add to your savings arsenal.

9. Make the Meat Last.

Don’t serve whole pieces of meat, instead explore your culinary side and be tactical about your cuts. Replace steak and fries with a steak casserole (which is likely to last days by the way)

Chop, slice and shred your way to an early retirement using online recipes and cookbooks.

10. Make Money-Conscious Choices.

Replace expensive recipes with homegrown options. Out of season veggies can be replaced by all year rounders like carrots or cabbage. Swap pricey cashew nuts for sunflower seeds.

11. Don’t Overeat.

Pack away half the food before serving. Some of us on our savings journey will have batch-cooked a large meal to serve dinner and keep the kids’ school lunches full for a few days, only to find out that everyone wanted a second serving and our money saving plan has gone out the window.

Portion the food into what you want today and save the rest in storage for the following days. Freeze if need be.

Snacks are the number one money-saving killer and we get it, they taste good. But tasty chips can be replaced with homemade apple crisps if you are willing to make it work.

12. Buy One Get One Free.

The best option for bulk buying – A buy one get one free scheme is the right move for us savings-fanatics looking to the future. Bulk buying is a great way to save and in-store offers can make it better.

We have all fallen into the trap of over buying when we see the decorated “Buy 1 Get 1 Free” signs so spend in moderation and plan how you will store your goods before purchasing a chicken farm worth of eggs.

13. Use the Cash Envelope System.

Put your grocery cash into an envelope at the start of the week and let time work its magic. Money saving experts recommend this technique as a psychological one as it states a clear no-go zone for your finances.

Let your credit cards rest and allocate the amount of cash you will need for groceries at the start of each week. Place the cash into an envelope and only take that cash to the store.

This is a great way to visualise your spending and it may shock you to see how many bills you drop on food.

We recommended adding a little extra to the envelope for any surprise deals you may encounter at the store.

14. Sign up For Produce Delivery.

Receiving groceries straight to your door will encourage you to cook more rather than buy read-made meals and snack packs. Organic options are expensive so keep it free range and treat yourself to a cookbook to guide you through your new at-home cheffing skills.

15. Chop Your Own Veggies.

It takes minutes to chop a carrot – is it worth spending half the minimum hourly wage extra just to get your veggies pre-diced? No.

Many shoppers don’t realise this trick and it can save you big bucks.

Practise mindfulness and enjoy the process, this is your time and cooking can be more than satisfying. Don’t be afraid to chop your onions into weird and wacky shapes for your family to enjoy.

16. Use a Loyalty Card.

These cards give cash back from your purchases and loyal customers to a store can save hundreds of dollars a year.

Save points and spend them as you please.

17. Don’t Make Groceries Your Identity.

Shop within your means – getting caught up in the finest fish and fancy starters is a recipe for disaster. Shopping at Whole Foods might make you feel accomplished but in reality, you are spending for the sake of spending.

You never see billionaires wearing designer brands and this applies to food. Many high-income households use online coupons like the ones we offer.

Health really is wealth and a nutritious cheaper plate will always fill you up more than a fancy one…and fill your savings.

18. What Organic Products Matter?

You don’t have to go organic to be healthier – “organic” sounds better but some non-organic foods are the wiser options for avid bargain hunters.

If pesticides are your concern, check out https://www.ewg.org/foodnews/summary.php to see what foods are okay to buy.

19. Try Buying Clubs.

Join your neighbourhood buying club or start one – Many churches offer the ability to exchange organic foods grown from gardens or buy wholesome ones.

Starting your own buying group amongst your neighbourhood is not only a great way to kickstart a shared shopping saving experience but also swap food with one another – like a neighborhood market.

20. Make Your Own Bread.

The best food to reduce your shopping cost is bread – An average loaf is $2.50 and sometimes one loaf a week isnt enough. Baking your own bread is super easy. Ingredients can be bought on a tight budget and you can make 10x the amount for the same price as a store-bought loaf.

Bread-baking can be done with basic tools and you can see why it was a popular ration during the war. The best part is that a bread machine can be picked up for less than $10 at thrift stores which will turn your house into a bread making powerhouse.

Desserts, school lunches and satiating starters are all achievable with some hearty home crafted dough.

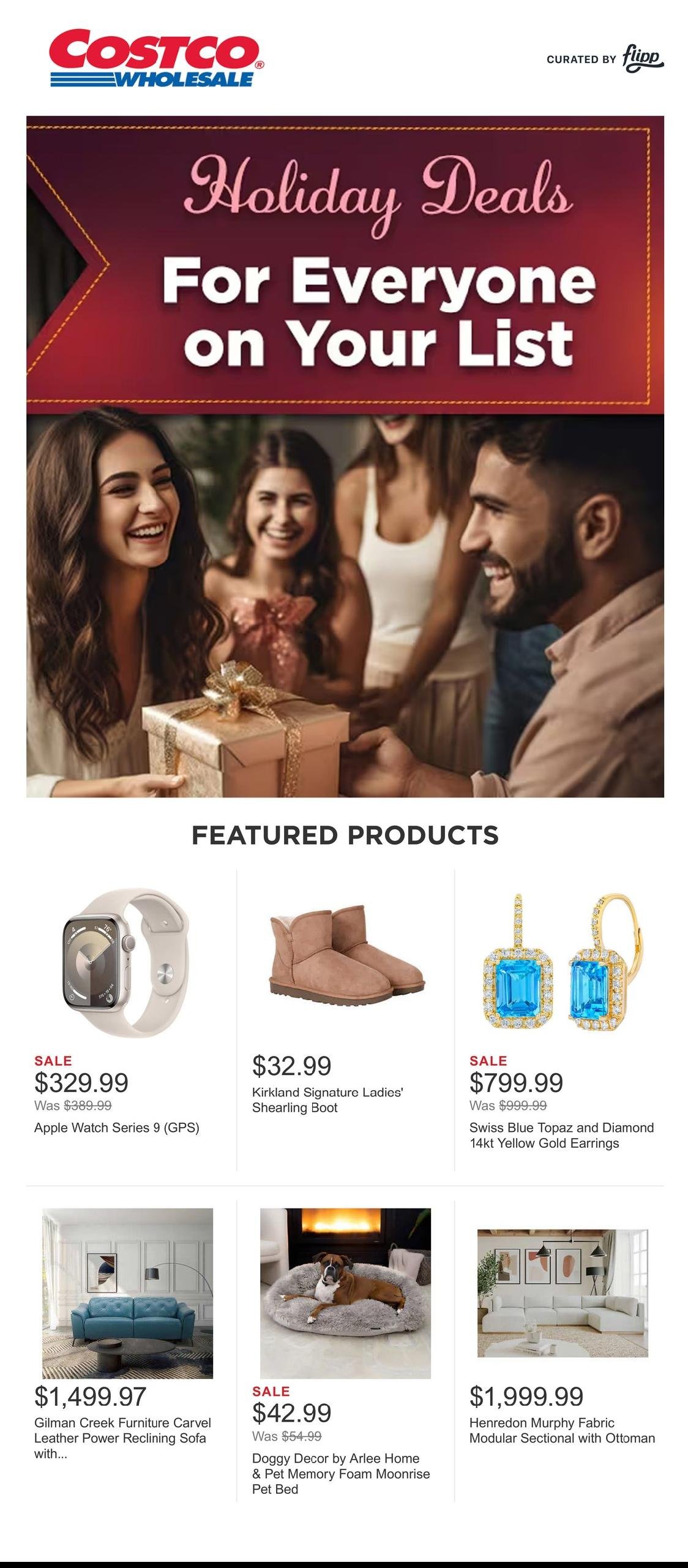

21. Try Costco.

Costco can be a blessing to your budget – but without the know-how, it can be an expensive shopping trip. Bulk shopping is best done here and if you are partial to an alcoholic drink, wines are cheapest at Costco.

22. Drink Water.

The best healthy choice you can make to reduce your grocery bill is replacing fizzy sodas with water.

The average US house spends $850 on sodas per year. That’s equivalent to working over 100 hours in a minimum wage job.

Make a list of essentials and highlight snacks and sodas. Make substitutions and swap fizzy drinks for sparkling water by the gallon.

23. Buy Essentials and Limit Treats.

Shopping for essential items is surprisingly easy and access to food that will get you through the week with a full stomach is easy. Like mentioned previously, talk with your family about what they think they will need throughout the week and rule out any non-essentials.

24. Stack Your Discounts.

Use coupons through email and newsletters – stacking multiple offers can lead to massive discounts. At EveryPayJoy, we allow our customers to claim multiple coupons at once and most can be layered on top of in-store coupons too.

Stores like Target offer in-store gift cards if you purchase certain items.

25. Skim the Creme-de-la Creme Deals

Look out for “Loss Leaders” – this is when a company purposely makes some products reduced to a price which is losing them money but attracts more customers which end up paying full price for all the other items in their shopping cart.

There is usually a “Loss Leader” sale each week so stock up on those reduced items.

Weekly Ads – How We Can Help You Save

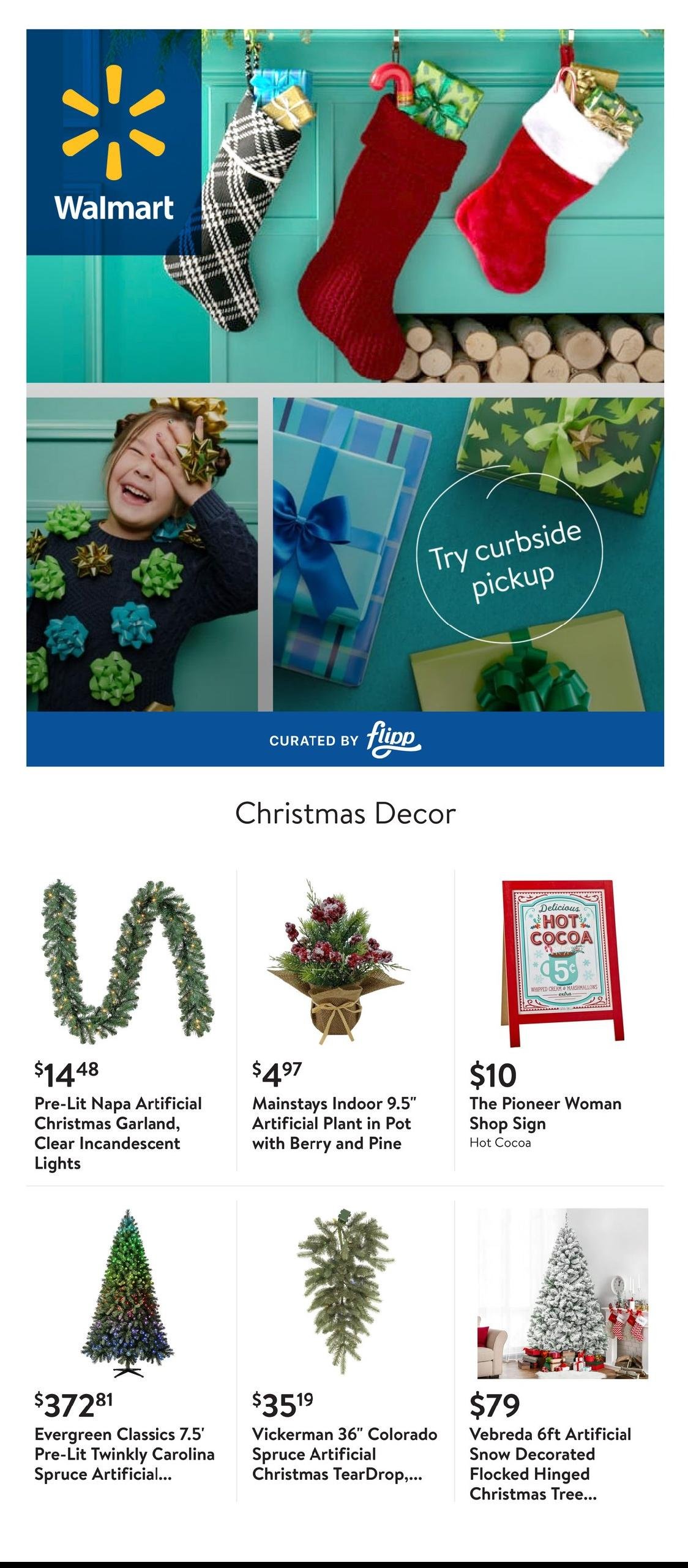

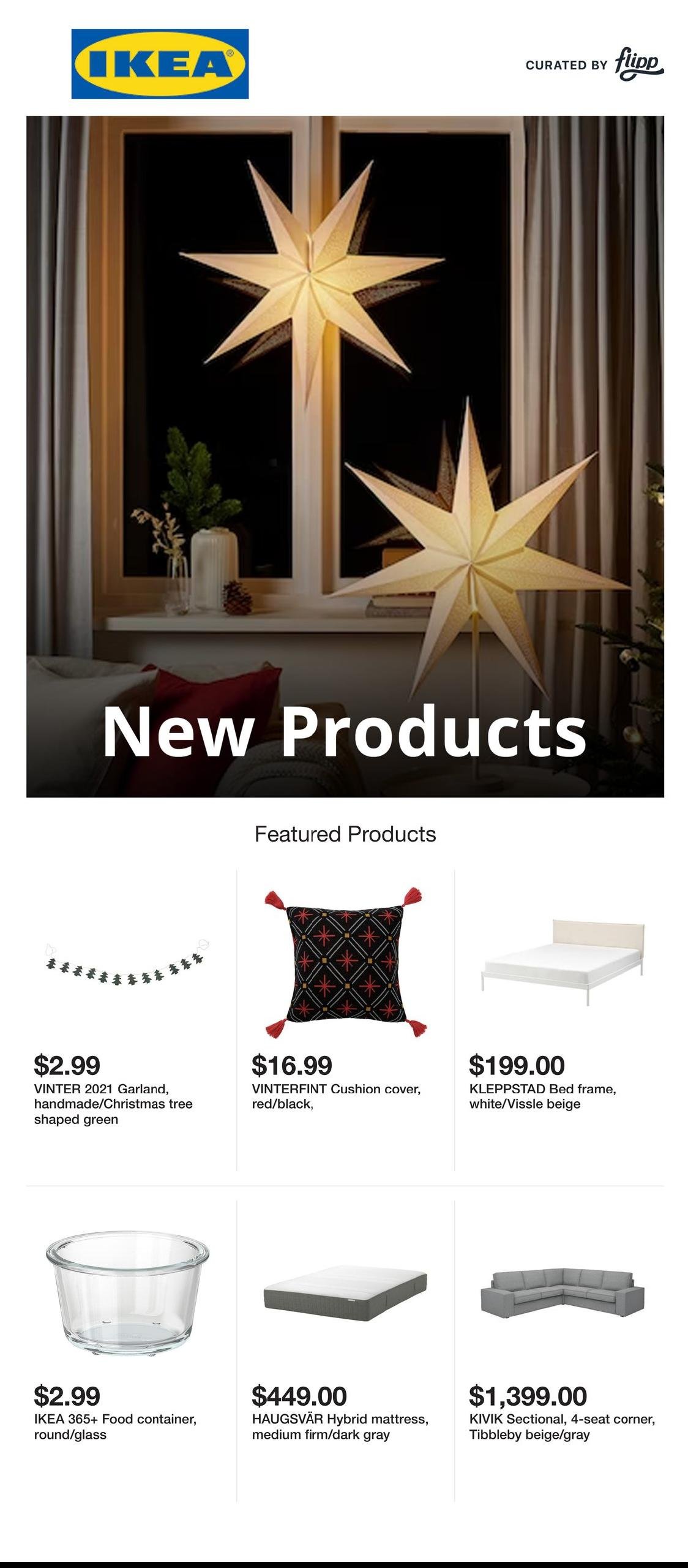

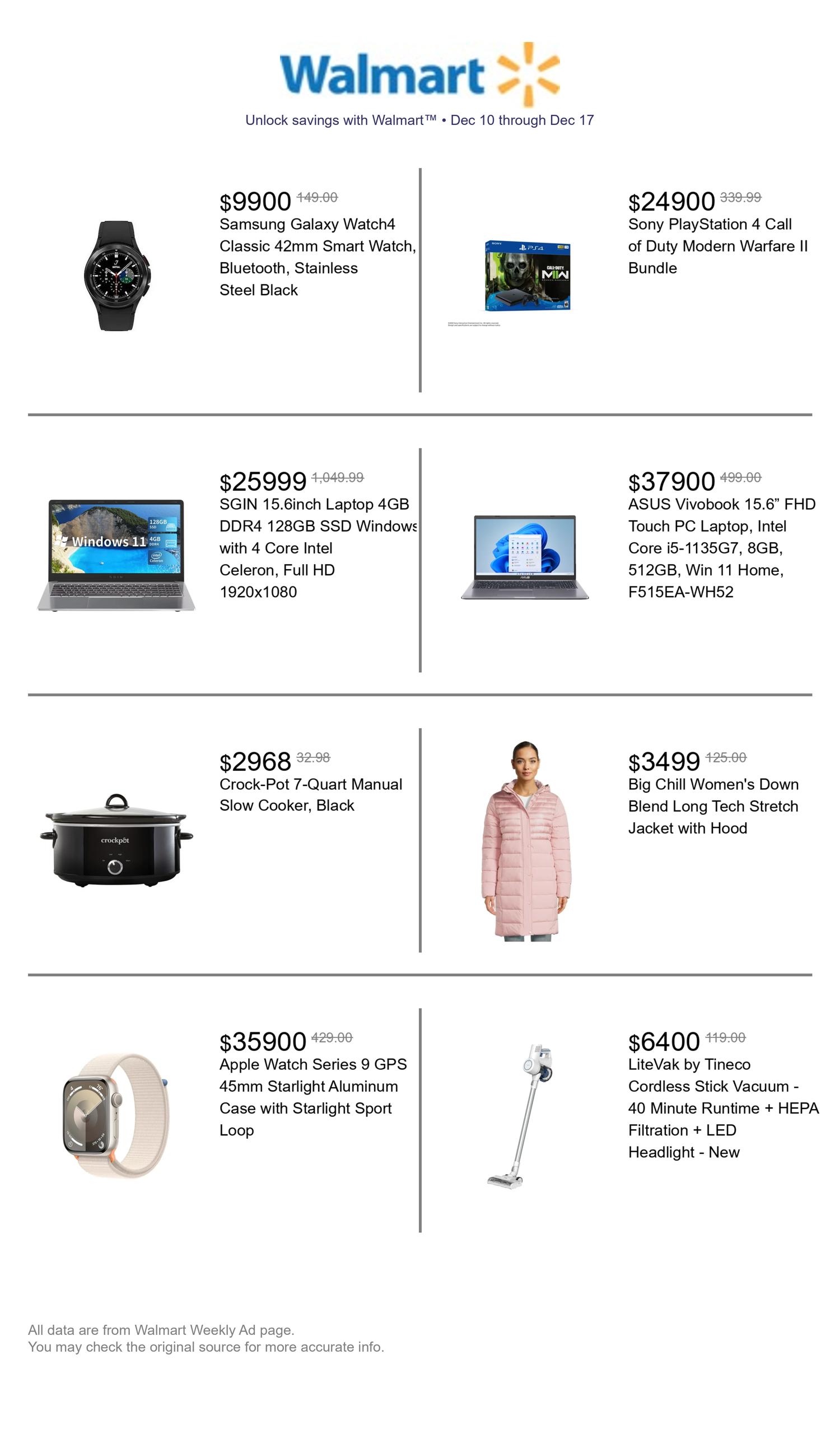

Our weekly ad offers are among the best options for saving money on your groceries. We offer coupons for 800+ stores and cover a ton of products.

Filter by category or search for a specific store and see what coupons we have available each week!

Our weekly ads stay up for 7 days so you can be flexible with your grocery trips throughout the week. They can be redeemed at any time during the week and a countdown timer ensures you know exactly when each coupon expires.

We want to help you save money on your groceries. Click here to view our deals this week.

Use our FAQs to find out more about exact times that offers drop for each store and how to get them emailed to you.

Cutting grocery spending doesn’t need to be complicated. Sticking to the basics will see you all the way through the process. At the end of the day, grocery savings will come down to you and your situation. For a Family of 6, problems may arise that a couple won’t have to deal with.

The main takeaway – take small steps and set realistic goals. Our pointers will give you the tools you need to save and combined with our coupons you will be on your way.

Remember, even the smallest change can build up and save you massive amounts of cash in the long run.

Source: